Seven theoretical reasons to buy a company, and one example from real life

M&A is complex, but most transactions can ultimately be traced back to a few fundamental drivers.

- You buy a market.

Access to customers, distribution, and a position that would take years to build. The downside: you might pay a premium for a market you can’t retain. - You buy technology.

Faster time-to-market and proven IP. The risk is messy integration, hidden technical debt, or losing the key people who built it. - You buy people.

Talent, culture, and execution capacity from day one. The danger is churn or cultural clashes that destroy the value you aimed to acquire. - You buy speed.

You skip time-consuming steps such as certifications, processes, or product maturity. The downside is inheriting complexity that slows you later. - You buy cost synergies.

Scale reduces unit cost. The risk is cutting away the very things that create value. - You buy defense.

You prevent a competitor from gaining an advantage. The problem: defensive deals rarely generate real growth. - You buy product breadth or brand.

To sell more to existing customers or gain credibility that’s hard to build from scratch. The risk lies in integration and cannibalization.

In the end, you’re buying something that’s difficult, expensive, or slow to build yourself.

And the downside is always the same: destroying the value that you paid for.

A real-world example:

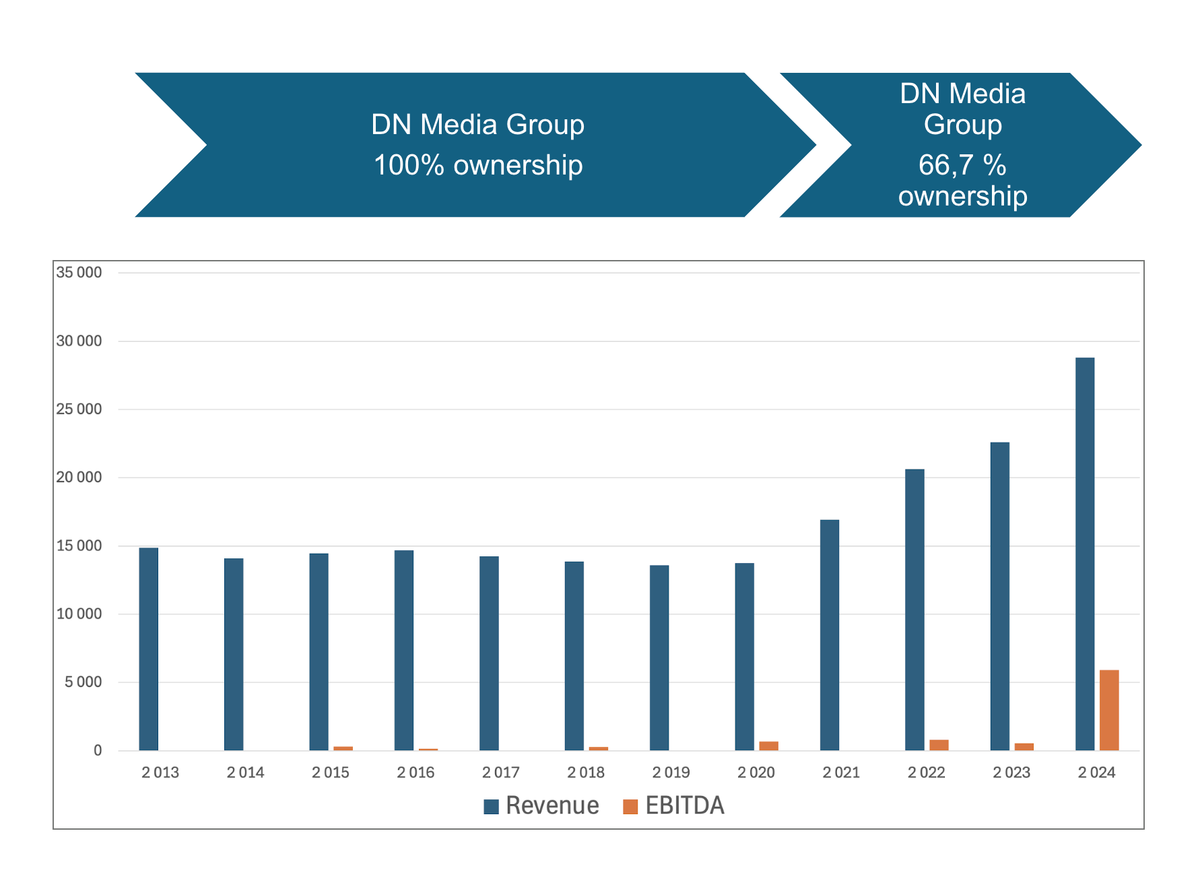

When Europower and enerWE merged in 2021, DN Media Group exchanged one-third of the shares in Europower for faster growth — a clear example of buying people and speed.

DN Media Group completed the process by acquiring the remaining shares from Metrics in May 2025.